Tuesday, December 13, 2011

I Was Born A Poor Black Child

I'm sure that's fine advice, but personally, if I were born a poor black child, I'd learn to play banjo or invent a little flying buttress to keep people's eyeglasses from sliding down their noses, because that worked so well for Steve Martin:

Oh, also: Gene Marks is a jerk.

BACK TO VICHYDEMS HOME

Sunday, September 11, 2011

The 9/12 Mentality

On 9/12, I was surprised when I opened my newspaper and found my letter, under the heading "Leaven Outrage With Reason," leading the day's letters, at the top of the Op-Ed page. It read:

Now there will be an outcry to "do something" -- as we should, by punishing those responsible and strengthening our nation's defense and intelligence installations in effective ways.

However, I hope our anger does not make us react unwisely. I fear these tragedies soon will be cited to justify "hawkish" actions such as withdrawing from peacekeeping missions or overspending on missile defense, at the expense of our other commitments.

To do so would please these terrorists almost as much as killing our people. I hope our leaders are resolute enough to punish those responsible swiftly and terribly, and wise enough to leaven their outrage with reason and a larger view of the nation's and the world's best interest.

Remaining true to our principles, supporting those around the world who honor democracy, healing our economy, and in general "staying the course" is the best and bravest response to those who wish us harm.

Re-reading that letter today, I am struck not by my prescience, but by my naivete.

I chose the word "hawkish" rather than "conservative" that day because I did not want to alienate my conservative compatriots. Like most liberals, I instinctively sought to place partisan and ideological divides behind me. Conservatives, I believed that day, were my allies against the people who wished us harm. And so I chose to narrow my concern to "hawks" rather than broaden it to "conservatives," even though "conservatives" was the first word that came to my mind.

And my perception even of that subset of conservatives, "hawks," was relatively mild back on September 12, 2001. On 9/12, the worst I could imagine of America's "hawks" was that they might lobby for us to withdraw from peacekeeping missions or waste a few billion dollars on an unneeded weapons program. I correctly feared that conservatives would seize the opportunity to advance military-industrial goals; but I did not conceive that they would so rapidly conflate Al Qaeda (evil people intending us harm) with the Taliban (ignorant rural yahoos generally content with destroying Buddhist bas-reliefs and oppressing their own wives and daughters). I could not imagine that they would launch us into the longest war in America's history; that they would persuade our own citizens that Saddam Hussein somehow was involved in the attack and start a new war there; or that their greed for war profits would contribute substantially to their bankrupting the nation, doubling the national debt and launching the Great Recession. I did not, on 9/12, realize how bad these people are.

Now I do.

Conservatives love to remind us how, on 9/12, we suspended our political and ideological differences and, briefly, considered ourselves to be one nation, indivisible and undivided. But the consequences of that suspension of ideology have been terrible: because of 9/11, liberals allowed conservatives to launch two wars, alienate a world that (on 9/12) universally supported us, pass the Patriot Act, steal money from education and healthcare to give to "defense" (i.e., offense), create new espionage and warmaking institutions, and turn our national self-image inward just when it should have been turned outward by injecting the Orwellian, totalitarian word "homeland" into our lexicon.

Liberals, Progressives and even Libertarians did not serve our nation well by adopting a "9/12 mentality." Quite the opposite: the 9/12 mentality -- well-intentioned, unable to conceive how deeply malevolent the Dick Cheneys of the world are -- allowed those malevolents to harm America far more mortally than Osama bin Laden ever could have.

On the tenth anniversary of 9/12, then, we on the Left should calmly but firmly reject the calls to adopt the 9/12 mentality again. We are not, today, as naive as we were ten years ago -- and America cannot afford for us to allow ourselves to be fooled again.

Friday, August 5, 2011

Shoot the People Who Ignored the Message

Before you start screaming at Standard & Poor's for downgrading U.S. debt for the first time in history, remember this: they warned G.O.P. leaders, very specifically, that U.S. credit ratings were at serious risk of downgrade EVEN IF the debt ceiling was lifted. In fact, S&P warned on July 14, and then reiterated on July 15, that a deal in the $1-2 trillion range (like the one that was enacted) would be insufficient, and kicking the can down the road (as the "Joint Committee" does) would be insufficient, and a deal that doesn't demonstrate that the G.O.P. is a serious partner in bending the debt curve (i.e., one that doesn't contain immediate new revenues as a sign of "seriousness") would be insufficient.

[Update, Aug. 5, 10:33 PT: full text of S&P's two "downgrade" press releases can be read at this link.]

On July 15, I wrote the following for PoliticusUSA:

The credit-rating agency Standard & Poors has released a statement that says, among other things, that merely raising the debt ceiling is not enough to prevent a downgrade of the United States’ credit rating, triggering market instability and causing the interest rate on U.S. debt to skyrocket.On July 18, I expanded on S&P's warnings in a piece for Alternet:

Late Thursday, the credit-rating agency Standard & Poor's released a statement announcing that merely raising the debt ceiling will not be enough to prevent a downgrade of the United States' credit rating for the first time in seventy years, potentially causing the interest rate on both government and private debt to skyrocket and destabilizing the entire economy. Remarkably, the statement also prescribed the specific numbers and conditions that would allow the U.S. to avoid such a catastrophe: to ensure a stable credit rating, any deal between Obama and the Republicans must reduce debt by $4 trillion, should include some "mix" of spending cuts and tax increases, and must involve concessions by both sides (a strong hint that the G.O.P. must consider closing tax loopholes, as well as a repudiation of Eric Cantor's assertion that merely attending negotiations is the only concession the GOP intends to make).

And on July 19, here on VichyDems, I discussed S&P's July 15 warning, which neither I nor any MSM reported had noticed immediately:In short, Standard & Poor's has put G.O.P. lawmakers on notice that if they take the easy way out instead of making the "Grand Bargain" that Obama has advocated for, including tax increases, they may be responsible for disrupting the U.S. economy.

The S&P statement clearly states that merely raising the debt ceiling, or implementing a deficit-reduction package in the $1-2 trillion range, will not be enough to prevent a costly rating downgrade, because it would show that the country is not serious about tackling the deficit....

A Standard & Poor's report dated July 15, the day after it threatened to downgrade U.S. debt if a debt-bending deal is not reached, underscores what I've been writing about: that merely lifting the debt ceiling, or authorizing a so-called "Debt Commission" to propose further spending cuts by the end of the year, is not enough to ensure that U.S. debt is not downgraded to AA status, with enormous "knock-on" effects to the rest of the economy.

I don't blame S&P for doing its job (identifying borrowers that are no longer as reliable as they used to be). Does anyone on Earth believe the U.S. is, indeed, as safe and reliable a borrower as it was in, say, 1999, when we had both a balanced budget and enough of a budget surplus to begin re-investing in education and infrastructure? In fact, by trying to warn U.S. politicians of the problem and avoid a downgrade, S&P was actually bucking pressures to aggressively downgrade flimsy AAA debtors, because there's currently far too much false AAA debt in the market right now. (That fact also answers the correct but irrelevant complaint that S&P and the other major credit-rating agencies contributed to the bad economy by failing to correctly identify the riskiness of AAA-rated mortgage-backed securities in the past. True, the agencies blew that call -- but the lesson they (properly) learned is to not take healthy-looking debtors at face value. A wise agency, burned once by a AAA credit bubble, should be more willing to downgrade AAA debt in the future -- exactly as S&P has just done.)

Standard & Poor's is just the messenger. It did exactly what it said it would do (and tried to avoid doing). The House G.O.P. is who refused to endorse a "clean bill" early, before S&P became an issue; the House G.O.P. is who refused to accept the "Great Compromise" that both Obama and S&P clearly wanted; the House G.O.P. is who refused to accept any new revenues in the immediate deal (though new revenues starting in 2013 are embedded in the plan), thereby showing S&P that they were not (in S&P's word) "serious."

Don't shoot the messenger. Shoot the people who ignored the message.

UPDATE, Aug. 5, 7:00 pm PT: Harry Reid, at least, is seeing the political leverage this provides; his office just issued the following statement:

REID: S&P ACTION SHOWS NEED FOR BALANCED APPROACH TO DEFICIT REDUCTIONWashington, D.C.- Nevada Senator Harry Reid issued the following statement following the decision by S&P to downgrade the U.S. credit rating from AAA to AA+:

“The action by S&P reaffirms the need for a balanced approach to deficit reduction that combines spending cuts with revenue-raising measures like closing taxpayer-funded giveaways to billionaires, oil companies and corporate jet owners. This makes the work of the joint committee all the more important, and shows why leaders should appoint members who will approach the committee’s work with an open mind - instead of hardliners who have already ruled out the balanced approach that the markets and rating agencies like S&P are demanding.”

UPDATE, Aug. 8, 2011: Standard & Poor's held a conference call this morning to explain its decision. Full audio of that call can be found here, as well as an excerpted clip of S&P's global Managing Director of Sovereign Debt Ratings saying that S&P's "upside scenario" is for the Bush tax cuts on the wealthy to expire. That alone, said S&P, would restore the U.S. rating from "outlook negative" to "outlook stable."

BACK TO VICHYDEMS HOME

Tuesday, August 2, 2011

The Democrats' Powerful Negotiating Advantage

Don't get me wrong: I agree wholeheartedly that, emotionally, this doesn't FEEL like a good deal for Democrats. But as Stephen Colbert explained brilliantly in his very first show, it's conservatives who make decisions based on how the truthiness feels; if liberals have anything going for them, it's the ability to understand and accept truth even when it doesn't feel like truth. So, as a professional mediator who trusts that liberal prefrontal cortices are beefier than liberal amygdalas, let me try to explain why Democrats are in a pretty darn good negotiating position right now:

Let's start with the reasonable assumption that Congress doesn't have the stomach to get into a huge new budget/tax brouhaha before the Joint Committee created by the so-called "Satan Sandwich" has a chance to meet and make its recommendations. (Avoiding such a fight is why Congress punted to a committee in the first place.) That means that the Committee's likely outcome is the main variable affecting the final outcome.

There are three broad options available to the Joint Committee: a mutual agreement that may affect entitlements but also raises taxes; a deadlock; or a Democratic cave-in. (Note that I didn't consider a G.O.P. cave-in; it's not their style.) Let's look at each option in turn:

OPTION ONE: The Committee does its job and agrees on a mutually-painful package of additional spending cuts (possibly including entitlement "reforms" of some kind) plus tax reforms, including closing loopholes and canceling tax expenditures, to increase revenues.

Liberals will disagree about whether any Democratic concessions were reasonable, and it is entirely possible that the Democratic negotiators will surrender too-large cuts to social programs or entitlements -- but any deal that raises taxes unquestionably will infuriate the GOP's Tea Party base and would seriously compromise its ability to demagogue budgets/deficits/Big Gubmint in the 2012 election. Regardless of how the Democratic base feels about Democratic concessions, any deal that allows the Dems to claim equal credit for fiscal responsibility, while stoking Tea Partiers into apoplexy over the GOP "traitors" who've whored away their tax-purity pledge, would be so palatable to independents (and bond-rating agencies) and so destabilizing to Republicans that Obama would almost be guaranteed reelection and Nancy Pelosi could well be restored to the Speaker's chair.

That's why I've referred to even a tiny tax increase as a "wafer thin mint": the GOP's House majority would explode if they brooked it. And if Dems control the House, then under the Constitution they get to initiate all spending, and the remaining nine years of this illusory "ten year plan" would suffer terminal defenestration.

Option One: net win for Democrats.

OPTION TWO: The Republican delegates to the Joint Committee refuse to do anything that the Tea Party might construe as "raising taxes." The Democratic delegates refuse to do anything liberals might consider harmful to entitlements. Both sides hang tough. The Joint Committee stalemates.

In the event of a stalemate, the "triggers" set forth in the Satan Sandwich automatically go into effect. Those cuts hit both sides -- but they don't hit Democrats in any vital organs. In fact, in electoral terms, they hurt Republicans more than they do Democrats.

(I don't want to get bogged down in discussions of cuts here, but in brief: the "triggers" include nasty cuts in domestic discretionary spending -- but, under the explicit terms of the Deal, Social Security and Medicare are exempt from those cuts, except for a 2% reduction in payments to providers, who primarily are a Republican constituency. But while the Democrats' key constituencies among Social Security and Medicare recipients would be relatively undisturbed, key Republican constituencies -- defense contractors and Tea Party-dense, military-dependent communities located primarily in conservative states and districts -- will be subjected to deep, automatic cuts.)

But the action's not on the cuts side of the equation, folks: it's on the revenues side. Republican negotiators entered the debt ceiling negotiations under the assumption that current tax rates were the baseline for measuring the next decade's tax impacts. If a deal simply continued current rates for the next ten years, it was "revenue neutral" in their eyes.

But that's not what current law says! Current law slates the 2001 and 2003 Bush tax cuts to expire at the end of 2012. What Republicans considered a "tax neutral" baseline actually would have been a huge tax cut when compared to the rates current law prescribes from 2013 forward. And that, in a nutshell, is why Obama and Boehner couldn't agree on a deal that raised taxes today: they don't even agree on what ruler to use.

But the law is the law, and the truth is the truth: if Congress is so dysfunctional that it does absolutely nothing but name post offices between now and 2013, tax rates will increase dramatically. Obama didn't need to gain a single concession from the Republicans in order to win "new revenues"; to both prevent a Presidency-jeopardizing economic collapse and win the "new revenues" he said he wanted, all he needed to do was exit the negotiations with a deal that prevented the nation from default and left current law in place.

Let me repeat that, because people don't seem to realize its importance: Current law slates the 1991 and 1993 Bush tax cuts to expire at the end of 2012. Obama didn't need to gain a single concession from the Republicans in order to win "new revenues" -- all he needed to do was exit the negotiations with a deal that prevented the nation from default and left current law in place.

Which, of course, is what this deal does.

So here's what Option Two (Joint Committee deadlocking) really does: it imposes spending cuts on both domestic spending that Democrats favor and defense spending that Republicans fetishize; it nevertheless protects the entitlements that are totemic to the Dem base; in electoral terms, it gores the Republicans' ox more than the Democrats'; and it results in automatic, across-the-board tax increases totaling roughly $3.5 trillion over the next decade.

Option Two: win for Dems.

[UPDATE, 8/3: Dave Weigel confirms here and here that the bill itself mandates current law, not current rates, as the baseline. See comments for discussion of some interesting, I think unintentional, consequences of this.]

It's hard to imagine even the most azure canine conservaDem not getting giggly over this kind of negotiating advantage. If the Committee reaches agreement that includes tax hikes, the GOP loses its base. If the Committee deadlocks, taxes return to pre-Bush levels and the budget balances itself in just a few years. Those are two very good outcomes for Dems.

Or, of course, there's what the Left's Cassandras expect to happen:

OPTION THREE: The Republican delegates to the Joint Committee demand both spending cuts and entitlement "reforms" that painfully cut benefits to the poor and the elderly. The Democratic delegates ask for tax hikes in return, but the Republicans steadfastly refuse. Despite the clear advantages that simply announcing "hung jury" would bring them, the Democratic delegates instead simply cave in.

There's no real reason why they would cave in, except for the fact that (as Paul Krugman keeps saying and Glenn Greenwald has painstakingly cataloged) Obama and those in his camp actually are closet Republicans who love spending cuts and know nothing about John Maynard Keynes and don't believe in fiscal stimulus and have decorated their private bathrooms with little framed cocktail napkins signed by Arthur Laffer and probably agreed with Ralph Nader back in 2000 that there was no difference between Al Gore and George Bush and, I suppose, think that John Kerry really was a coward in Vietnam, too. [UPDATE 8/03: In fairness to GG and PK, yes, I'm speaking hyperbolically -- but not as hyperbolically as I wish.]

In this view, it's a given that the Democratic delegates will give away the farm in exchange for absolutely nothing of value, because that's what Krugman and the folks at FireDogLake say Obama Dems always do. Option Three is inevitable, because Democrats suck and Obama is governing "to the right of Richard Nixon" and his supporters are "the dumbest motherfuckers in the world." And then, even though Barack Obama retains the power to veto a bill that gives the Republicans everything and the Democrats nothing, he doesn't veto it. Because, again, he's a terrible negotiator who secretly hates liberal ideals anyway.

Option Three: Democrats suck, and (as the Teapartiers have said all along, but in reverse) Obama's a Manchurian candidate bent on selling us out, so of course the Republicans win, as always. Sigh.

Of course, the endgame probably won't be decided by the Joint Committee at all. The Committee will meet and issue a report, but there's plenty of time for the parties to negotiate a different compromise after the Committee reports but before either the automatic triggers or the automatic tax hikes go into effect. And there's some legitimate fear, based on Obama's past less-than-steely negotiating history over the public option and the last extension of the Bush tax cuts, that here is where a bad deal for Democrats may be made.

But the contours of any alternative agreement will be shaped by the likely outcomes of the "triggers" scenario -- what we mediators call the Best Alternative to a Negotiated Agreement, or BATNA. In other words, neither party is likely to negotiate an agreement that's worse than the outcome of NOT reaching an agreement.

Under the deal President Obama just negotiated, Democrats' BATNA is a survivable set of spending cuts, a diminished Pentagon budget that hurts Republican home states and districts, automatic tax hikes that almost guarantee a balanced budget in less than a decade (reinforcing the Democratic narrative that, as Bill Clinton showed, Democratic Presidents are better fiscally than Republican ones), and a Republican base that's furious -- as an election looms -- at its own representatives for allowing those tax hikes to occur.

With a good BATNA like that, even poor Democratic negotiators almost can't help but cut a good deal for themselves. And (flipping around and looking at things from the other perspective), with a lousy BATNA like theirs, even the hardest-nosed, most regressive Republican negotiators have little choice but to accept some sort of spanking -- for instance, by letting Dems raise taxes on the richest Americans while preserving low tax rates for the middle class.

Yes, Option Three might happen -- if D.C. Dems are the utter fools a few pundits claim them to be. And if they let themselves be beaten that badly as this plays out, I'll be among the first to label them fools.

But Options One or Two are far, far, FAR more likely. And instead of wrapping themselves in sackcloth and ashes, crying in woe and beating themselves up for their leaders' factitious sins, Progressives would be wiser to join ranks and work together to pressure Reid and Pelosi with one simple, bridge-building demand: that the Democratic side of the Joint Committee be represented by reasonably intelligent liberals who understand how much leverage their President has given them in this deal -- and have the toughness to play out that good hand.

BACK TO VICHYDEMS HOME

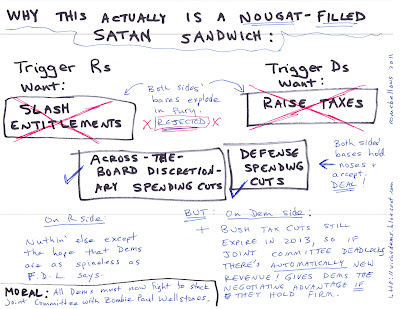

Why It's a NOUGAT-FILLED Satan Sandwich

That is, it's a Democratic win IF progressives can keep their sh*t together, stop the idiotic and nonproductive internecine warfare between so-called Firebaggers and Obamabots, and pull together to demand that the Joint Committee include true Democrats who'll hold firm rather than Blue Dogs and Vichies who'll surrender on the electorally all-important new revenues issue.

Here, in a highly sophisticated graphical format developed after over one minute of communications-strategy research and diligent labor, is why the Satan Sandwich contains a nummy, pro-Democrat nougat center:

BACK TO VICHYDEMS HOME

Friday, July 29, 2011

The Christian-Rock Roots of the G.O.P.'s "No Compromise" Rigidity

In politics, there always have been varying degrees of acceptable compromise, depending on the individual and the issue. And, yes, some people are less flexible (1964's Barry Goldwater, preaching that "extremism in the pursuit of virtue is no vice!", comes to mind), and some issues are less negotiable, than others. On the other hand, the purist absolutism of "no compromise whatsoever" seems to be a modern phenomenon -- and the refrain "no compromise" has exploded since Barack Obama was elected President.

In October 2010, Rep. Mike Pence (R-IN) said that earlier Republican majorities had allowed "altogether too much compromise" and promised that “there will be no compromise” if Republicans took control again (as they did). John Boehner, discussing how he would work with Barack Obama if he became Speaker, promised purity: "This is not a time for compromise, and I can tell you that we will not compromise on our principles.” Darrell Issa tried to redefine the term into meaninglessness: "You know, the word 'compromise' has been misunderstood,” he said, clarifying that his job will be “Getting America back to the center right where it exists.” And those leaders' "no compromise" stance has seeped its way down to the grassroots, so that, for example, a gun-rights advocate can write, "One of the reasons our system of government has lost its way is legislators fail to stand on principle and instead give into compromise."

The refrain is at the heart of the current debt ceiling impasse. Ron Paul: "“What you and I need is someone who stands for conviction over compromise.” Eric Cantor, asked "is there any compromise you can make on taxes?," answered "No"; his position is that merely showing up at negotiations is compromise enough. Michelle Bachmann is sending signals that no compromise is acceptable. Rush Limbaugh, quoting Ayn Rand, asked "where do you compromise between food and poison" and, later, advised the G.O.P. to hang tough, saying, "winners do not compromise" -- a statement Fox News calls an "epic rallying cry." A right-wing blogger states straightforwardly, "Republicans must never attempt to compromise with Democrats."

No compromise. No compromise. No compromise. That phrase sounded oddly familiar -- and then I remembered why.

In 1982, I was college roommates, and good friends, with a born-again Christian. My friend (I'll call him "Matt") was a very good guy: a hard studier, wryly and intelligently funny, an exuberantly bonecrunching flag football player, always happy to pop open a few beers on a sunny afternoon or do serious damage to a bottle of V.O. while we played cards. Although he was a "born-again," conservative in his interpretation of the Bible, and sincere about his faith, he wasn't intolerant of others -- and, significantly, his faith didn't infect his politics; the professional Christian Right simply hadn't advanced that far yet. (Once, when we listened to some audiotapes of a then-unfamiliar Jerry Falwell, he agreed with me that Falwell was strangely shrill and theologically unsound, and was uncomfortable with his God-and-Mammon blending of religion, politics, and fundraising.)

But while Matt wasn't an extremist back then, he was at least a prototype of future extremists -- the subject of an early-Reagan-era experiment in conservative religio-political engineering. Early political fundamentalists like Falwell, Chuck Colson, Pat Robertson, and James Dobson, and related groups like Young Life and Dobson's Focus On The Family, were starting to use Christian radio and books and campus organizations, not to save souls, but to see whether the religious integrity of good people like Matt could be twisted into political servience -- whether, by cleverly marketing certain issues that blended morality and politics, like abortion, people like Matt could be convinced that conservative politics and conservative Christianity were branches of the same vine, so that they would sweat, bleed and even die for conservative politicians as if they were angels of the Lord Himself.

Of course, they succeeded.

An early sign of the religiopolitical messaging that was pushed on people like my friend back in the late '70s and early '80s was a seminal album by the immensely talented and influential Christian musician Keith Green: 1978's "No Compromise."

"No Compromise" was tremendously successful on the Christian rock charts, helped establish Christian rock as an economically viable market, and influenced countless later musicians. After Green died in a plane crash in 1982, both his biography and a tribute album also were named "No Compromise," the phrase Green believed summed up his entire religious philosophy:"No Compromise is what the whole Gospel of Jesus is all about..." And, apparently disregarding copyright laws, innumerable later Christian musicians gave their albums the same name.

Although the surface meaning of Green's "No Compromises" statement may have been religious, it always had political overtones. The original album cover didn't show a Christian refusing to bow down to a pagan idol, along the lines of Robert Service's poem "The Soldier of Fortune." Rather, it showed a crowd bowing down to some kind of political leader, a king or pasha of some sort -- and the Christian in the image is refusing to bow down to him. In other words, "No Compromise" always promoted political wilfulness and resistance, not just religious integrity.

My roommate had that album, of course, as well as a T-shirt with the same slogan and a cross. And he talked a lot about what it meant, which to him was that a person of integrity should not only refuse to compromise his faith, but refuse to compromise any of his ideals, in any circumstances. Over time, his fondness for the phrase turned him from a reasonable, spiritual person into a rigid, inflexible moralist -- with "moral" being defined only by the people and ideas he considered authoritative. Sadly, the very independence that he had (rightly) treasured as a moral good had been twisted, psychologically, into the very subservience to worldly men that he considered unfaithful to his God and wanted passionately to avoid.

Since then, "No Compromise" has continued to serve as right-wing religionists' version of "No Fear!" or "Just Do It!" -- but it also has spread to the political world. The slideshow below has a sampling of "No Compromises" images, showing how the phrase has expanded from a niche Christian pop album, to church youth groups and advertisements, to Tea Party and anti-immigration symbolism, and even to become the logo of an international military weapons manufacturer. And, to the extent it has shaped the ethics of a generation of (now middle-aged) social conservatives who now serve, lobby, petition, and fundraise for the G.O.P., how it has become the Republican Party's counterproductive maxim for how to govern in a diverse, secular democracy.

BACK TO VICHYDEMS HOME

The Debt Ceiling Debacle, Explained in Popular Video

Nearly all my recent, wonky posts on the D.C. debacle have contained links to video clips that help illustrate my points. Below, I've collated these clips (and a couple of new ones) into a sort of "tick tock" or "explainer" of the debt ceiling debate as it stands today. Enjoy! Learn! And don't tell the M.P.A.A.!

- Barack Obama offers the Republicans everything they could ever want in a bill, so long as they also accept just one tiny little tax hike (that the Tea Party would rebel against). C'mon, just one little tax hike -- "It's wafer thin!" (originally in this post)

- The G.O.P., which initially thought it was being clever by linking the debt ceiling to spending cuts, begins to realize that it has made a classic blunder. (originally in same post as previous)

- John Boehner, Mitch McConnell, Eric Cantor, and Grover Norquist begin to realize what a trap Obama set for them, and hold this meeting (secretly videotaped) to brainstorm clever ways out. ("Put that thing away, you're gonna get us all killed!") (originally in this post)

- The parties play chicken, racing each other to that August 2 deadline. As the cliff approaches, Boehner suddenly realizes both that his own caucus won't support his bill -- and also that maybe it wasn't such a great idea to buy that cool motorcycle jacket with the extraneous strap on the sleeve. (originally in this post)

- With Boehner locked upstairs in his bedroom crying, serious Wall Street Republicans missing in action, and the Tea Party (lacking adult supervision) breaking into Boehner's liquor cabinet, jumping on the nation's couches and watching "GGW" on pay-per-view, the previously-unified House G.O.P. splinters into combative, ungovernable factions that can't agree on what bedtime should be, let alone on a plan to save America from default. ("Splitters!") (originally in this post)

- But never fear: Arthur Jensen will now explain why, no matter how Boehner or the Tea Party squirm and squeal, the debt ceiling WILL be lifted and the markets WILL be saved. ("I have seen the face of God!") (originally in this post, from 2006)

So keep your chin up! I'm confident that even our dysfunctional government will muddle through somehow. Meanwhile, don't panic! Instead, just remember to always look on the bright side of life.

BACK TO VICHYDEMS HOME

Thursday, July 28, 2011

How Prime Minister Pelosi and the American Parliament Can Solve the Debt Crisis

The truth is, American politics are as rife with factions as anyone else. Religious-conservative Prairie Muffins have nothing in common with the uber-rich hedonists who fund the Heritage Foundation, but both are Republican; union autoworkers have no natural affinity for Birkenstocked environmentalists, but both tend Democratic. What we call "The Right" actually is a grab-bag of paleoconservatives, Tea Partiers, Christian Dominionists, Libertarians, gun nuts, and a handful of LaRouchies (who, like Zoroastrian fundamentalists or Bruce Willis, don't realize they're ghosts yet). On what we call "The Left," nominally like-minded liberals perpetually respond to electoral success by devolving immediately into warring clans: Obamabots versus Firebaggers, resurrected New Democrats (who, I gather, seem to have snipped the labels out of their Izods) shoving things to the right while Bernie Sanders and Ralph Nader pray for someone to primary Obama from the left.

In a Parliament, each of these groups would comprise its own political party: Democrats, Republicans, New Democrats, Greens, Tea Partiers, Dominionists, etc. And before the Parliamentary election, they would be studiously separate. Each would win some seats in Parliament, but most of the time none would win an absolute majority, so after the election, coalition-building would begin: Republicans and Democrats alike would woo the Libertarians by pitching small government and personal freedom, respectively; Dems would send Jim Wallis as an envoy to try and peel off a few Dominionists by appealing to social justice issues.

Sometimes the politics of Parliamentary coalition-building make very strange bedfellows, as in the British Parliament today (where the governing coalition was formed by what in America would be Republicans and Greens). But horses would be traded, a majority would be cobbled together, and that strange coalition would elect the new Prime Minister.

In America, we think we do things differently -- but we don't. We simply conduct our coalition-building and odd-bedfellow-matchmaking BEFORE the popular election instead of afterward. This is clearest during Presidential primaries, where each candidate effectively represents a minor sub-party (e.g., Romney representing the center-right, Bachman the Tea Party, Pawlenty the often-overlooked Boring Vote). Those sub-party primary candidates fight not only to win the nomination, but also to claim a place for their constituents in the final administration. (That's why can't-win candidates still find it worthwhile to enter the fray.) As each back-runner drops out, he or she horse-trades with the front-runners, exchanging their endorsement (and their faction's votes) for some position or increment of power in the new regime. That's how primary losers wind up being Vice-Presidents or Secretaries of State: they have traded their own coalition's support to help form the governing majority, in exchange for a slice of the power. And whoever builds the largest coalition wins the election. It's the same as Parliament, but done before the popular election rather than after it.

That's a long introduction to a very short thought, which is this: sometimes Congress can function like a Parliament, with the coalition-building occurring after the body is constituted. Whenever Republicans win the votes of Blue Dog Democrats, that's Parliamentary-style coalition-building. Whenever Democrats peel off the moderate Maine Twins, that's Parliamentary-style coalition-building.

It's very possible that late this week or early next, the U.S. House of Representatives will transform itself into the House of Commons. House Speaker John Boehner (R-OH) is in a death spiral: unable to control the Tea Party branch of his own caucus, bearing most of the popular blame for the debt ceiling debacle, stalked from behind by Eric Cantor, reduced to griping publicly about how much his job sucks, his grip on the Speakership itself slipping away -- and, since no one really fears the threats or trusts the promises of a soon-to-be ex-Speaker, he seems to have lost the clout even to pass his own weak debt-ceiling bill through the house he nominally leads. In short, his coalition is falling apart.

In a parliament, this is precisely the moment when someone would shout "no confidence!" and call for new elections. The factions would reshuffle: the Tea Party would support Eric Cantor for Speaker, but more adult Republicans, aware of how deathly serious a default and debt downgrade would be, would look elsewhere for a champion. And if a No Confidence vote were held in the House of Representatives today, neither the Democrats nor the Republicans would have a simple majority.

But if the Republican brand is failing, there remains one faction in the House that could form itself a majority government:

Adults.

You know, serious politicians who are able to look into the abyss and have the sense not to plunge into it.

Congress-turned-Parliament would allow allow the factions in Congress to reshuffle, create a new majority comprised of strange bedfellows allied for a common (if sadly ephemeral) purpose, prevent a catastrophic default next Tuesday, and possibly even hammer out a deal to bend the medium-term debt curve so that Standard & Poor's and Moody's don't downgrade the U.S. debt by the end of the summer (which they will do if we only lift the debt ceiling). All it would take is for Nancy Pelosi to step up, craft a reasonable, non-punitive debt ceiling/spending bill, and pitch it to the adults in the room.

A good Pelosi "grown-ups" bill would do three things:

1) Lift the debt ceiling until after the elections;

2) Sail into Standard & Poor's non-downgrade safe harbor by both cutting $2.5 trillion or so in spending over the next decade and by raising slightly under $1 trillion in new revenue by simply closing some of the more egregious tax expenditures and loopholes and trimming back the spendthrift Bush tax cuts on the rich (goring both liberals and conservatives -- but like it or not, S&P's threat must be responded to); and

3) Firewall any significant cuts to Social Security, Medicaid, or Medicare until at least 2013.

That bill could be supported, albeit with predictable griping, by every House Democrat. And it already is privately supported by many 24 House Republicans; all that Pelosi needs is to get 24 of them to step up and support it publicly.

The Tea Party would scream bloody murder. Rush Limbaugh would lambaste the "traitorous twenty-four." So what. For some Rs, the remaining good and serious ones, those blasts would be badges of honor.

Yes, Boehner could prevent a Pelosi solution from coming to the floor -- but Boehner, with nothing left in his toolkit, the world's economy on the bubble, his "friend" Eric Cantor at his throat, his Speakership (if not his seat) already lost, 24 Republicans begging him to get out of their way, and the U.S. Chamber of Commerce (which is on Obama's side in this fight) instructing him to damn well get out of the way, may well allow such a bill to be voted on. Again, he doesn't love the Tea Party; he hates it, and he is beholden first to Wall Street, which has been collaborating with Obama to force Boehner into this precise predicament to hobble the uppity Tea Party. Push come to shove, Boehner would (probably tearfully) allow the vote.

And if he did, then he and those 24 "turncoat," patriotic Republicans would save the nation's economy, and possibly the world's. Boehner would, most likely, see that his Speakership is lost, and retire. The 24, depending on their districts, would either win re-election as common-sense pragmatists and move on to brilliant careers as pragmatic, common-sense centrists, or would lose their seats and move on to lucrative jobs offered by an eternally grateful Wall Street (which, again, is firmly in the "solve this problem" camp). For all of them, life would go on.

Democrats plus 24: that's all it takes to solve this problem. All it would take to make it possible is for Pelosi to recognize that as the Republican caucus crumbles into its constituent factions, Congress briefly becomes the House of Commons -- giving her the chance to craft a new majority from the rubble of the G.O.P.

BACK TO VICHYDEMS HOME

Friday, July 22, 2011

Reprise: How Obama is Pwning Boehner in Debt Talks

As I watch Barack Obama, live, telling the nation that John Boehner has walked out of debt negotiation talks, I am feeling both optimistic and prescient. For convenience, I'm excerpting the "predicting the future" portion of this post (on this same site) from July 13, which I believe is holding (and will continue to hold) true:

BACK TO VICHYDEMS HOMEAdmittedly, Obama might not be able to pull off his hat trick. In particular, if the House were to cut its losses, abandon negotiations altogether and unilaterally pass a clean, stand-alone, two-year debt ceiling increase, it would be hard for Harry Reid not to allow a similar bill to pass the Senate, and even harder for Obama to veto it (though if he has nerves of steel he could do so, and force the House Republicans to accept a package of spending cuts and tax increases in the minutes before their midnight deadline). But in the meantime, Obama will keep slapping pucks at the G.O.P.'s beleaguered orange goalkeeper, trying to go three for three.

If winning a landslide reelection and reclaiming the House are indeed his true objectives, look for Obama to do the following:

1. Keep Taking Republicans to the Boards: At this point, this is full-contact politics. Look for Obama to keep up the hard play. Today's body blow: Obama rejected one version of a debt ceiling increase, "insisted on one comprehensive deal" (i.e., one including tax increases), threatened to veto any short-term approaches, promised to "stake his presidency" on the issue, and walked out of a meeting with Canter. Look for more of the same.

2. Divide and conquer: Obama's game depends on splitting the Tea Party Caucus from the Wall Street gray eminences, and foolish ideologues like Cantor from pragmatists like Boehner. Look for him to exploit every opportunity to drive wedges -- as he did today when he walked out of a meeting with Cantor, to Boehner's almost certain aggravation. If Obama's plan is working, on the other hand, look for ideological freshmen like Mike Lee (R-UT) to stop saying stupid, divisive things -- a sign that their elders are explaining how the world really works. And also look for the better strategists on the G.O.P. side to air increasingly desperate plans to avoid being forced to raise taxes -- which will, in turn, bring fresh waves of outcry from party purists.To aggravate Republicans' internal divide, also look for Obama to uncharacteristically toss darts and jibes at the TeaParty to aggravate it further, at least until the deal's down to the short strokes.

3. Move to the Right on Debt: If the G.O.P. suggests a clean debt ceiling increase, Obama will co-opt the "debts matter" argument and, with less-politically-savvy purists like Paul Krugman screaming epithets at him, will demand budget cuts (and, by the way, just one wafer-thin little tax increase!) as part of any deal. He will reiterate, over and over, that if not now, when? He will, to the dismay of the people at FireDogLake, adopt Frank Lautenberg talking points, crying that he does not want Sasha and Malia to inherit debt simply because John Boehner isn't willing to cut spending (with, again, just one tiny, insignificant tax increase attached).

4. Appear to be Caving on Cuts and Entitlements: Perversely, if Obama is focused on retaking the House, he will temper his hard-line position on tax increases by being almost ridiculously open to spending cuts and entitlement "reform" that his base considers intolerable. There are several reasons for this. First, the "raising taxes" pill is so poisonous that nearly any sacrifice that leads to them swallowing it is worthwhile. Obama is willing to eat a lot of garbage in exchange for the Republicans swallowing one teeny, tiny little tablet of cyanide. Second, any major cuts that pass the House must still pass the (Democrat-controlled) Senate. Finally, regaining both Houses of Congress opens the possibility of Democrats repairing any damage to entitlements that today's deal causes.

5. Almost inexplicably, keep avoiding a "clean vote" on the debt ceiling: Even down to the last minute. Good games of chicken take it all the way to the edge of the cliff.

Finally, how will we know if Obama has completely pwn3d the G.O.P.? Easy: the House of Representatives will, before the default deadline, pass a negotiated package that lifts the debt ceiling, contains something that can be characterized by wingnuts as a tax increase, and infests the G.O.P.'s 2012 platform's "debt hawk" plank with so much dryrot that it will be unsafe for them to stand on it.

Tuesday, July 19, 2011

Standard & Poor's Underscores: Merely Lifting Debt Ceiling is NOT Enough to Preserve AAA Credit

The action on the U.S. government's 'AAA' long-term and 'A-1+' short-term ratings reflects our view of two issues: the failure to raise the federal debt ceiling so as to ensure that the government will be able to continue to make scheduled payments on its obligations, and our view of the likelihood that Congress and the Obama Administration will agree upon a credible, medium-term fiscal consolidation plan in the foreseeable future. (See "United States Of America 'AAA/A-1+' Ratings Placed On CreditWatch Negative On Rising Risk Of Policy Stalemate," published July 14, 2011.)Let's repeat that: S&P is likely to downgrade U.S. debt if the nation either fails to lift the cap or fails to reassure ratings agencies that it's serious about "credible, medium-term fiscal consolidation" -- i.e., bending the debt curve. And S&P's earlier report clearly defined "credible, medium-term fiscal consolidation plan" as one in the roughly $4 trillion range, involving some "mix" of spending cuts and revenue enhancement, involving compromises by both parties, put in place sooner rather than later.

As it stands, we see at least a one-in-two likelihood that we could lower the long-term rating on the U.S. within the next three months-–by one or more notches, into the 'AA' category–-if we conclude that Washington hasn't reached agreement on the latter of these two issues.

In other words: not the McConnell plan (which merely lifts the debt ceiling, albeit in a complicated way); not the Reid-McConnell plan (which lifts the debt ceiling and makes small spending cuts but otherwise kicks the can down the road to a so-called "deficit commission"); and not "Cut, Cap & Balance" (which is pure showmanship, not designed to pass).

Meanwhile, the bad news isn't limited to the government itself. The foreseeable "knock-on" effects are already happening: New York Life, Northwestern Mutual, and other blue-chip insurers, and Fannie Mae, Freddie Mac, and home and farm loan banks were placed on notice of possible downgrades Friday, and Moody's placed five states (Virginia, Maryland, New Mexico, South Carolina, and Tennessee) on downgrade notice today. Because, as S&P says, "no financial institution can carry a higher rating or outlook than its sovereign," the entire U.S. economy will be degraded, either directly or indirectly, if the U.S. government is downgraded.

Far from being bad actors, the ratings agencies are trying very hard not to downgrade U.S. debt, even though there is increasing concern in financial markets that there is too much nominally AAA debt out there already. No, the agencies are not the bad guys here; like Paul Revere, they keep sounding the warning (as here, here and here).

Is anybody in Washington listening?

BACK TO VICHYDEMS HOME

Sunday, July 17, 2011

Financial Heavyweights Tell G.O.P. to Raise Taxes -- But They're Not Listening

As the president and Congressional Republicans squabble over how to avoid a default on the nation's financial obligations, the financial world's heavy hitters are increasingly signaling that they want the G.O.P. to embrace the $4 trillion "Grand Bargain" preferred by Barack Obama, including revenue increases that some Republicans consider politically suicidal. Yet G.O.P. lawmakers don't seem to be listening, steering instead toward a politically easier solution that appeases the Tea Party but may not be enough to avoid economic catastrophe.

Late Thursday, the credit-rating agency Standard & Poor's released a statement announcing that merely raising the debt ceiling will not be enough to prevent a downgrade of the United States' credit rating for the first time in seventy years, potentially causing the interest rate on both government and private debt to skyrocket and destabilizing the entire economy. Remarkably, the statement also prescribed the specific numbers and conditions that would allow the U.S. to avoid such a catastrophe: to ensure a stable credit rating, any deal between Obama and the Republicans must reduce debt by $4 trillion, should include some "mix" of spending cuts and tax increases, and must involve concessions by both sides (a strong hint that the G.O.P. must consider closing tax loopholes, as well as a repudiation of Eric Cantor's assertion that merely attending negotiations is the only concession the GOP intends to make).

In short, Standard & Poor's has put G.O.P. lawmakers on notice that if they take the easy way out instead of making the "Grand Bargain" that Obama has advocated for, including tax increases, they may be responsible for disrupting the U.S. economy.

The S&P statement clearly states that merely raising the debt ceiling, or implementing a deficit-reduction package in the $1-2 trillion range, will not be enough to prevent a costly rating downgrade, because it would show that the country is not serious about tackling the deficit:

"U.S. political debate is currently more focused on the need for medium-term fiscal consolidation than it has been for a decade. Based on this, we believe that an inability to reach an agreement now could indicate that an agreement will not be reached for several more years. We view an inability to timely agree and credibly implement medium-term fiscal consolidation policy as inconsistent with a 'AAA' sovereign rating...."

Standard & Poor's bombshell capped a week filled with communiques from the financial world telling politicians in general to stop posturing and Republicans in particular to be more flexible on taxes. On July 7, a blistering editorial in The Economist took Republicans to the woodshed:

"[T]he Republicans are pushing things too far. Talks with the administration ground to a halt last month, despite an offer from the Democrats to cut at least $2 trillion and possibly much more out of the budget over the next ten years. Assuming that the recovery continues, that would be enough to get the deficit back to a prudent level. As The Economist went to press, Mr Obama seemed set to restart the talks.

"The sticking-point is not on the spending side. It is because the vast majority of Republicans, driven on by the wilder-eyed members of their party and the cacophony of conservative media, are clinging to the position that not a single cent of deficit reduction must come from a higher tax take. This is economically illiterate and disgracefully cynical."

The Economist even advocated for the tax hikes that Obama has demanded (and which many House Republicans have staked their political careers on refusing):

"This newspaper has a strong dislike of big government; we have long argued that the main way to right America’s finances is through spending cuts. But you cannot get there without any tax rises. In Britain, for instance, the coalition government aims to tame its deficit with a 3:1 ratio of cuts to hikes. America’s tax take is at its lowest level for decades: even Ronald Reagan raised taxes when he needed to do so.

"And the closer you look, the more unprincipled the Republicans look. Earlier this year House Republicans produced a report noting that an 85%-15% split between spending cuts and tax rises was the average for successful fiscal consolidations, according to historical evidence. The White House is offering an 83%-17% split (hardly a huge distance) and a promise that none of the revenue increase will come from higher marginal rates, only from eliminating loopholes. If the Republicans were real tax reformers, they would seize this offer."

Last Tuesday, nearly 500 U.S. business leaders, including solidly conservative groups like the U.S. Chamber of Commerce and the Financial Services Forum, signed a letter urging both sides to make "hard choices" to adopt a long-term solution, not just a temporary extension of the spending cap. The next day, the rating agency Moody's also warned of a downgrade unless lawmakers negotiated a "substantial and credible" debt-reduction deal.

Thursday, as Obama dismissed negotiators to decide over the weekend how they wanted to proceed, Standard & Poor's issued its warning to the federal government, then followed Friday with additional warning that it also may downgrade the credit ratings of several blue-chip financial firms that are heavily invested in U.S. Treasuries, including New York Life Insurance Co. and Northwestern Mutual Life Insurance Co., simply because "no financial institution can carry a higher rating or outlook than its sovereign," and those of some other financial services organizations (including Federal Home Loan and Farm Credit System banks and the mortgage loan guarantee companies Fannie Mae and Freddie Mac) that have "direct links to, or reliance on, the federal government." Those warnings are likely to reverberate into the rest of the financial sector over the coming week.

Standard & Poor's remarkably prescriptive warnings, which sound more like World Bank admonishments to a fiscally irresponsible Third World nation than an assessment of the most secure investment on Earth, would seem to be the final blow to beleaguered Republicans' ability to resist any semblance of new taxes. And some senior Republican statesmen have, indeed, been trying to educate the party's junior members about the seriousness of the problem. Former Senate Budget Committee chairman Pete Domenici, who helped negotiate the nation's last balanced budget under President Bill Clinton, has teamed with former George H.W. Bush Treasury undersecretary Jay Powell to issue a report saying that tax purists like Minnesota congresswoman Michelle Bachmann are "wrong" and calling for Republicans to embrace some tax hikes. Federal Reserve Chairman Ben Bernanke, originally a Bush appointee, warned House Financial Services Committee that a failure of U.S. Treasury bonds "would throw shockwaves through the entire global financial system."

But the message does not seem to have penetrated the Republican caucus, which appears irreconcilably split between economic pragmatists and anti-tax ideologues and therefore is continuing to pursue economically inadequate, but politically palatable, solutions:

Asked by Obama Thursday to return by Saturday with at least a general idea of what direction they would like to pursue, House Republicans let the deadline slip and instead plan to spend the next week passing a "Cut, Cap & Balance" bill and balanced budget amendment that do not address the immediate problem and have no chance of passing the Democrat-controlled Senate. In the Senate, Minority Leader Mitch McConnell (R-KY) and Majority Leader Harry Reid (D-NV) reportedly are continuing to work on a "hybrid" plan to temporarily raise the cap and enact smaller spending cuts without tax increases -- precisely the sort of plan that Standard & Poor's has said would result in a downgrade of America's debt -- plus a "debt commission" that would consider further deficit reduction measures later, which may or may not demonstrate the kind of "seriousness" that the financial markets say they want. And Senate Minority Whip John Kyl (R-AZ) continues to parrot anti-tax talking points, referring Sunday to the president's "absolute obsession with raising taxes" and "[j]ob-killing taxes." At the other extreme, budget hawk Tom Coburn (R-OK) said Sunday that he will offer a plan that closes some tax loopholes -- but his plan seeks to cut a massive $9 trillion by making punitive reductions to entitlements and social programs, and he acknowledges it stands no chance of passing.

The debt ceiling question has become a proxy war over the soul of the Republican Party, pitting old-school pragmatic conservatives who understand how complex the financial system is against anti-tax and Tea Party ideologues. Wall Street clearly is allying itself with the pragmatists, even if doing so means that Republicans may suffer electoral setbacks in 2012. Rank-and-file Republicans appear to be struggling to decide which of their impulses is stronger: the desire to help the economy recover, or the desire to retain control of the House of Representatives in the face of Tea Party wrath over tax hikes. If they follow their current course, and if Standard & Poor's keeps its promises, they may wind up with neither.

BACK TO VICHYDEMS HOME

Thursday, July 14, 2011

Standard & Poors to G.O.P.: "We'll Downgrade U.S. Credit Rating If You Don't Accept Obama's Offer"

The credit-rating agency Standard & Poors has released a statement that says, among other things, that merely raising the debt ceiling is not enough to prevent a downgrade of the United States' credit rating, triggering market instability and causing the interest rate on U.S. debt to skyrocket. What's more, S&P is attaching numbers and conditions to its statement: to ensure a stable credit rating, any deal between Obama and the Republicans must reduce debt by $4 trillion, should include some balance of cuts and revenues (ie, tax increases), and will involve concessions by both sides (a thinly-veiled repudiation of Eric Cantor's assertion that merely attending negotiations is the only concession the GOP intends to make).

In short: the G.O.P. must grow up and accept Obama's offer, including politically suicidal tax increases, or the U.S. economy will tank.

The U.S. Chamber of Commerce and other business leaders already have written to tell John Boehner to stop screwing around and take a deal, the credit-rating agency Moody's had threatened to downgrade U.S. debt, and a blistering editorial in The Economist last week took Republicans to the woodshed:

"[T]he Republicans are pushing things too far. Talks with the administration ground to a halt last month, despite an offer from the Democrats to cut at least $2 trillion and possibly much more out of the budget over the next ten years. Assuming that the recovery continues, that would be enough to get the deficit back to a prudent level. As The Economist went to press, Mr Obama seemed set to restart the talks.The Economist even advocated for the tax hikes that Obama has demanded (but which the GOP knows may cost them control of the House of Representatives in 2012):"The sticking-point is not on the spending side. It is because the vast majority of Republicans, driven on by the wilder-eyed members of their party and the cacophony of conservative media, are clinging to the position that not a single cent of deficit reduction must come from a higher tax take. This is economically illiterate and disgracefully cynical."

"This newspaper has a strong dislike of big government; we have long argued that the main way to right America’s finances is through spending cuts. But you cannot get there without any tax rises. In Britain, for instance, the coalition government aims to tame its deficit with a 3:1 ratio of cuts to hikes. America’s tax take is at its lowest level for decades: even Ronald Reagan raised taxes when he needed to do so.Coming on top of this, S&P's remarkably detailed statement -- almost a prescription for what Congress must do, much as the World Bank instructs third world nations to adopt austerity measures -- may be the final blow to beleaguered Republicans, who are tasked tonight and tomorrow with deciding which way to proceed with debt ceiling negotiations -- but who now appear to have little choice in the matter."And the closer you look, the more unprincipled the Republicans look. Earlier this year House Republicans produced a report noting that an 85%-15% split between spending cuts and tax rises was the average for successful fiscal consolidations, according to historical evidence. The White House is offering an 83%-17% split (hardly a huge distance) and a promise that none of the revenue increase will come from higher marginal rates, only from eliminating loopholes. If the Republicans were real tax reformers, they would seize this offer."

A fascinating side question is whether the Obama administration had a role in whether or when S&P issued its statement -- and when Obama knew that the statement would be issued. It's already been reported that the Obama Administration primed the financial community months ago to put pressure on the G.O.P. (There's some benefit to having Wall Street insiders on the Cabinet!)

Earlier today, Obama appeared to retreat from his previous hard-line, must-raise-taxes position, and asked Republicans to choose which of three options they preferred: (1) work toward $4 trillion in total debt reduction over the next decade, including some tax increases and closed loopholes; (2) settle for a lower, $1.5-1.7 trillion debt reduction without tax increases; or (3) Mitch McConnells' complex plan that essentially simply raises the debt ceiling without any deficit reduction.

While Obama was making that seemingly-generous offer, however, Standard & Poors was preparing to issue its report announcing that options (2) and (3) would be ruinous to financial markets and to the nation's ability to borrow -- i.e., that only Obama's first option, the $4 trillion, must-increase-taxes plan he has pushed for all along. Taking it all together, I strongly suspect Obama knew the S&P report was coming and timed the day's events perfectly, coming away looking more reasonable than ever while making sure that the Republicans' box is getting smaller and smaller.

The key portion of the Standard & Poors report is printed below:

"We expect the debt trajectory to continue increasing in the medium term if a medium-term fiscal consolidation plan of $4 trillion is not agreed upon. If Congress and the Administration reach an agreement of about $4 trillion, and if we to conclude that such an agreement would be enacted and maintained throughout the decade, we could, other things unchanged, affirm the 'AAA' long-term rating and A-1+ short-term ratings on the U.S.

"Standard & Poor's takes no position on the mix of spending and revenue measures that Congress and the Administration might agree on. But for any agreement to be credible, we believe it would require support from leaders of both political parties.

"Congress and the Administration might also settle for a smaller increase in the debt ceiling, or they might agree on a plan that, while avoiding a near-term default, might not, in our view, materially improve our base case expectation for the future path of the net general government debt-to-GDP ratio. U.S. political debate is currently more focused on the need for medium-term fiscal consolidation than it has been for a decade. Based on this, we believe that an inability to reach an agreement now could indicate that an agreement will not be reached for several more years. We view an inability to timely agree and credibly implement medium-term fiscal consolidation policy as inconsistent with a 'AAA' sovereign rating, given the expected government debt trajectory noted above.

Further delays in raising the debt ceiling could lead us to conclude that a default is more possible than we previously thought. If so, we could lower the long-term rating on the U.S. government this month and leave both the long-term and short-term ratings on CreditWatch with negative implications pending developments."

BACK TO VICHYDEMS HOME

Wednesday, July 13, 2011

It's The Election, Stupid: How Obama is Leveraging Debt Ceiling Negotiations to Win Reelection and Regain the House

The G.O.P.'s Three Weaknesses:

Since Ronald Reagan's election in 1980, the G.O.P. has had a very good run in Washington: they have persuaded Americans that "liberal" is a dirty word, retained the "fiscal conservative" moniker despite octupling the national debt, and rebounded after presidential setbacks in 1992 and 2008 by exploiting Clinton's and Obama's nonexistent "coattails" to gain impressive new Congressional majorities. But while the conservative juggernaut has been formidable, the Republicans have made three blunders in the past thirty years that exposed their vulnerabilities and knocked them profoundly off their pace.

Here are the G.O.P.'s three "classic blunders," the errors that for them are the political equivalents of getting involved in a land war in Asia:

1. Running a weak Republican for President against a charismatic, Kennedy-esque young Democrat;

2. Shutting down the government, as Newt Gingrich did in 1995-6; and

3. Breaking a promise not to raise taxes (which cost George H.W. Bush reelection in 1992).

The G.O.P. can't help but repeat blunder number 1 in 2012: the G.O.P. field is weak, and Obama will be the Democratic candidate. Obama is now maneuvering to force them to make blunders 2 and 3, as well -- a "hat trick." If he succeeds, the result -- and, most likely, his objective from the start -- will be not only his reelection, but Democratic control of the House of Representatives as well.

Here are the clues, tea leaves and puzzle pieces that support this analysis:

1. Obama Finds a Spine and Keeps Insisting on Raising Taxes: Until now, Obama has been over-quick to buy in to Republican frames. Republicans argue that the debt is too high (even though it's not); Obama agrees that the debt is too high and counterproductively supports budget cuts during a recession. Republicans say that healthcare should still be paid for privately; Obama agrees and doesn't even allow singlepayer advocates a seat at the healthcare reform table. Republicans argue that tax cuts are the key to an effective stimulus package; Obama agrees and squanders nearly half the stimulus on tax cuts.

But now Republicans are screaming that taxes shall not be raised -- and Obama, for the first time, is pushing back and insists that a tax increase is his one non-negotiable. Yet, strangely, Obama is not adamant about how large the tax increases ("revenue enhancements") must be; he is blithely willing to accept spending cuts that are disproportionately larger than any tax increases; all he really demands is that there must be some tax increases. He even signals a willingness to carve large, bloody chunks out of sacred cows like Social Security and Medicare and throw them on the grill for Republicans' dining pleasure -- if only the Republicans will just accept some itty, bitty little tax increases. And, at the same time, the G.O.P. suddenly seems panicked about the issue.

Why is Obama so hell-bent on increasing taxes, when conventional wisdom in an election (and a recession) says that's suicidal? And why is the G.O.P. suddenly turning pale and insisting gaspingly that it "will not, will not, will not EVER!" submit to increasing taxes, like a maiden hopelessly proclaiming her eternal chastity before a horde of slavering Mongols?

Poppy Bush.

In 1988, the first President Bush won the White House largely on the strength of a single, clear promise: "read my lips: no new taxes." Then, being a well-educated, old-school Republican and a pragmatist (who had called Reagan's supply-side theories "Voodoo Economics"), he adapted to changing circumstances and agreed some tax increases were necessary. His base exploded, his supporters stayed home on election day, and Bill and Hillary evicted George and Barbara after only one term.

The entire G.O.P. freshman class has, in more or less identical words, taken the same pledge as George H.W. Bush, and the Tea Party, like Grover Norquist but without his political sophistication, has made "no new taxes" its latest line in the sand. It's a binary, black-white, either-or test: either you increase taxes or you hold the line, and if you choose wrong, we will jettison you and back someone with more commitment to the anti-tax cause. And because a larger than usual proportion of the current G.O.P. majority are freshmen, and because freshmen are especially vulnerable in their first reelection, the G.O.P. majority is highly vulnerable to being overturned in 2012.

Obama knows this -- and so do the G.O.P.'s (relative) grown-ups, who now realize they're in a box and are looking desperately for a way out. That's why Boehner complained bitterly today that the only thing Obama is inflexible on is "these damn tax increases." That's why, as Brian Beutler has astutely observed here and here, even anti-tax zealot Grover Norquist has figured out what's happening and is moderating his absolutism to help the Republicans escape Obama's trap. That's also why the Wall Street Journal, always the oracle of Big Money and even more so now that it is part of Rupert Murdoch's propaganda machine, is defending Mitch McConnell's strange debt-ceiling proposal (which is simply a device for surrendering to Obama without having to raise taxes, made intentionally overcomplex in hopes that the Tea Party rank-and-file won't realize what's going on).

Obama is forcing the G.O.P. to pull a Poppy and break their pledge. The G.O.P. knows that it will pay a terrible price if it does so. But, when the final seconds tick their way to a default, those wiser G.O.P. heads also know that they will follow the financially-sensible bidding of Big Money rather than the suicidal bidding of the spoiled children who think they run the Tea Party, and will do what Obama (and Wall Street) demand -- after which they will start privately telephoning friends in important places to look for job openings beginning in January, 2013.

2. In a Tie, The Call Goes to the Democrat: But, you say, isn't Obama under the same pressure as Republicans to lift the debt ceiling, so that he's as likely to hit the brakes as they are before the nation drives off the cliff?

Nope.

True, Obama doesn't want the U.S. to default. But he has skilfully positioned himself as the more reasonable player by offering tax cuts much larger than his proposed tax increases, by leaking to the Washington Post and others that he is willing to alienate his base by gouging Medicare and Social Security, and by manipulating the Republicans into huffily walking out of negotiations (and into Obama's trap). The majority of Americans will blame Republicans, not Obama, for any default -- and both sides know it.

History bolsters this conclusion. The last time a Democratic President and an ideologically purist Republican Congress allowed a stalemate to shut down the government, Republicans lost in the public's mind (and those Republicans, the infamous "Contract With America" class led by Newt Gingrich, was then voted out of office, allowing Democrats to regain the House). A default now will be much, much more harmful than the brief shutdown that occurred in 1995-1996 , and the negative consequences for Republicans will be proportionately worse as well.

In the leadup to the current negotiations, Boehner tried to position the G.O.P. differently than Gingrich did in 1995, but he clearly has failed. Politically, Obama has less to lose than the Republicans do -- and, as one of my father's truisms says, you should never get in a fight with someone who has less to lose than you do. In Boehner's nightmares, he could go down in history as the man who allowed the nation to double-dip into the Second Great Depression and permanently stripped the G.O.P. of the "fiscal grown-up" label it has claimed since before WWII. He won't take that risk.

3. Wall Street will not allow the G.O.P. to cause a default: Pundits and talking heads keep focusing on the Tea Party's likely reaction to a tax increase, forgetting that fiscally there is another, more deeply imbedded, subtler but infinitely more mercenary influence on Republican politics: Big Money. Big Money -- Wall Street, the U.S. Chamber of Commerce, the myriad networks of individual donors and independent campaign ad funders and potential post-Congressional-career employers that are the G.O.P.'s (and, to be fair, half of the Democratic Party's) true constituents -- calmly allows its minions to showcase and speechify and engage in tiny, irrelevant acts of political theater to meet the needs of the political moment, but the ground of Big Money's existence is the integrity of the financial system. Are big banks about to go under? D.C. is mobilized overnight, ideology is set aside, and supposed free marketeers like John Boehner tearfully beg Congress to intervene in the free market to bail them out.

If Big Money can make conservative congresscritters scramble to serve its will when a few banks are on the bubble, what do you think it can accomplish when the integrity of the U.S. government -- the ground of the U.S. financial system's being, the issuer of public tender and surety of U.S. businesses' credibility in world markets -- is in jeopardy? Answer: anything it wants. Big Money can tell Boehner to step down and retire, and he will. It can tell Paul Ryan to jettison his budget, and he will. It can tell Eric Cantor to back down from his hardcore rhetoric, and Ron Paul to silently brook a larger federal government, and they will.

The pressure's already building -- the normally pro-Republican U.S. Chamber and other business leaders, carefully prepped and cultivated by the Administration well in advance of this crisis (!), already have started leaning on Republicans to take a deal, and Moody's is threatening to downgrade U.S. securities. If Obama can sustain his bluff to the bitter end, the G.O.P. will do whatever it takes to prevent a default, because their masters are telling them to do so. (And don't believe Cantor's assertion that passing a bill raising taxes is impossible: the unofficial "Wall Street Caucus" has always been larger than the Tea Party Caucus, and combined with House Democrats, who outnumber Tea Party Caucus members three-to-one, can easily pass whatever is needed.)

The process of persuading the G.O.P. to accept the inevitable has already begun; it's precisely the slowly-dawning realization that Republican control of the House is at stake that's making G.O.P. leaders look so shaky lately. It's why Mitch McConnell has, remarkably, proposed an alternative bill that would actually increase the power of a Democratic president -- and why Obama has rejected the offer. It's why the White House adamantly refuses to accept any short-term, pressure-relieving solutions.

Admittedly, Obama might not be able to pull off his hat trick. In particular, if the House were to cut its losses, abandon negotiations altogether and unilaterally pass a clean, stand-alone, two-year debt ceiling increase, it would be hard for Harry Reid not to allow a similar bill to pass the Senate, and even harder for Obama to veto it (though if he has nerves of steel he could do so, and force the House Republicans to accept a package of spending cuts and tax increases in the minutes before their midnight deadline). But in the meantime, Obama will keep slapping pucks at the G.O.P.'s beleaguered orange goalkeeper, trying to go three for three.

If winning a landslide reelection and reclaiming the House are indeed his true objectives, look for Obama to do the following:

1. Keep Taking Republicans to the Boards: At this point, this is full-contact politics. Look for Obama to keep up the hard play. Today's body blow: Obama rejected one version of a debt ceiling increase, "insisted on one comprehensive deal" (i.e., one including tax increases), threatened to veto any short-term approaches, promised to "stake his presidency" on the issue, and walked out of a meeting with Canter. Look for more of the same.

2. Divide and conquer: Obama's game depends on splitting the Tea Party Caucus from the Wall Street gray eminences, and foolish ideologues like Cantor from pragmatists like Boehner. Look for him to exploit every opportunity to drive wedges -- as he did today when he walked out of a meeting with Cantor, to Boehner's almost certain aggravation. If Obama's plan is working, on the other hand, look for ideological freshmen like Mike Lee (R-UT) to stop saying stupid, divisive things -- a sign that their elders are explaining how the world really works. And also look for the better strategists on the G.O.P. side to air increasingly desperate plans to avoid being forced to raise taxes -- which will, in turn, bring fresh waves of outcry from party purists.To aggravate Republicans' internal divide, also look for Obama to uncharacteristically toss darts and jibes at the TeaParty to aggravate it further, at least until the deal's down to the short strokes.

3. Move to the Right on Debt: If the G.O.P. suggests a clean debt ceiling increase, Obama will co-opt the "debts matter" argument and, with less-politically-savvy purists like Paul Krugman screaming epithets at him, will demand budget cuts (and, by the way, just one wafer-thin little tax increase!) as part of any deal. He will reiterate, over and over, that if not now, when? He will, to the dismay of the people at FireDogLake, adopt Frank Lautenberg talking points, crying that he does not want Sasha and Malia to inherit debt simply because John Boehner isn't willing to cut spending (with, again, just one tiny, insignificant tax increase attached).