Before you start screaming at Standard & Poor's for downgrading U.S. debt for the first time in history, remember this: they warned G.O.P. leaders, very specifically, that U.S. credit ratings were at serious risk of downgrade EVEN IF the debt ceiling was lifted. In fact, S&P warned on July 14, and then reiterated on July 15, that a deal in the $1-2 trillion range (like the one that was enacted) would be insufficient, and kicking the can down the road (as the "Joint Committee" does) would be insufficient, and a deal that doesn't demonstrate that the G.O.P. is a serious partner in bending the debt curve (i.e., one that doesn't contain immediate new revenues as a sign of "seriousness") would be insufficient.

[Update, Aug. 5, 10:33 PT: full text of S&P's two "downgrade" press releases can be read at this link.]

On July 15, I wrote the following for PoliticusUSA:

The credit-rating agency Standard & Poors has released a statement that says, among other things, that merely raising the debt ceiling is not enough to prevent a downgrade of the United States’ credit rating, triggering market instability and causing the interest rate on U.S. debt to skyrocket.On July 18, I expanded on S&P's warnings in a piece for Alternet:

Late Thursday, the credit-rating agency Standard & Poor's released a statement announcing that merely raising the debt ceiling will not be enough to prevent a downgrade of the United States' credit rating for the first time in seventy years, potentially causing the interest rate on both government and private debt to skyrocket and destabilizing the entire economy. Remarkably, the statement also prescribed the specific numbers and conditions that would allow the U.S. to avoid such a catastrophe: to ensure a stable credit rating, any deal between Obama and the Republicans must reduce debt by $4 trillion, should include some "mix" of spending cuts and tax increases, and must involve concessions by both sides (a strong hint that the G.O.P. must consider closing tax loopholes, as well as a repudiation of Eric Cantor's assertion that merely attending negotiations is the only concession the GOP intends to make).

And on July 19, here on VichyDems, I discussed S&P's July 15 warning, which neither I nor any MSM reported had noticed immediately:In short, Standard & Poor's has put G.O.P. lawmakers on notice that if they take the easy way out instead of making the "Grand Bargain" that Obama has advocated for, including tax increases, they may be responsible for disrupting the U.S. economy.

The S&P statement clearly states that merely raising the debt ceiling, or implementing a deficit-reduction package in the $1-2 trillion range, will not be enough to prevent a costly rating downgrade, because it would show that the country is not serious about tackling the deficit....

A Standard & Poor's report dated July 15, the day after it threatened to downgrade U.S. debt if a debt-bending deal is not reached, underscores what I've been writing about: that merely lifting the debt ceiling, or authorizing a so-called "Debt Commission" to propose further spending cuts by the end of the year, is not enough to ensure that U.S. debt is not downgraded to AA status, with enormous "knock-on" effects to the rest of the economy.

I don't blame S&P for doing its job (identifying borrowers that are no longer as reliable as they used to be). Does anyone on Earth believe the U.S. is, indeed, as safe and reliable a borrower as it was in, say, 1999, when we had both a balanced budget and enough of a budget surplus to begin re-investing in education and infrastructure? In fact, by trying to warn U.S. politicians of the problem and avoid a downgrade, S&P was actually bucking pressures to aggressively downgrade flimsy AAA debtors, because there's currently far too much false AAA debt in the market right now. (That fact also answers the correct but irrelevant complaint that S&P and the other major credit-rating agencies contributed to the bad economy by failing to correctly identify the riskiness of AAA-rated mortgage-backed securities in the past. True, the agencies blew that call -- but the lesson they (properly) learned is to not take healthy-looking debtors at face value. A wise agency, burned once by a AAA credit bubble, should be more willing to downgrade AAA debt in the future -- exactly as S&P has just done.)

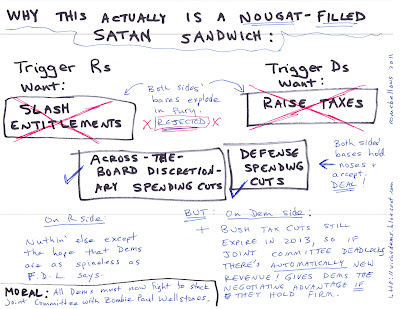

Standard & Poor's is just the messenger. It did exactly what it said it would do (and tried to avoid doing). The House G.O.P. is who refused to endorse a "clean bill" early, before S&P became an issue; the House G.O.P. is who refused to accept the "Great Compromise" that both Obama and S&P clearly wanted; the House G.O.P. is who refused to accept any new revenues in the immediate deal (though new revenues starting in 2013 are embedded in the plan), thereby showing S&P that they were not (in S&P's word) "serious."

Don't shoot the messenger. Shoot the people who ignored the message.

UPDATE, Aug. 5, 7:00 pm PT: Harry Reid, at least, is seeing the political leverage this provides; his office just issued the following statement:

REID: S&P ACTION SHOWS NEED FOR BALANCED APPROACH TO DEFICIT REDUCTIONWashington, D.C.- Nevada Senator Harry Reid issued the following statement following the decision by S&P to downgrade the U.S. credit rating from AAA to AA+:

“The action by S&P reaffirms the need for a balanced approach to deficit reduction that combines spending cuts with revenue-raising measures like closing taxpayer-funded giveaways to billionaires, oil companies and corporate jet owners. This makes the work of the joint committee all the more important, and shows why leaders should appoint members who will approach the committee’s work with an open mind - instead of hardliners who have already ruled out the balanced approach that the markets and rating agencies like S&P are demanding.”

UPDATE, Aug. 8, 2011: Standard & Poor's held a conference call this morning to explain its decision. Full audio of that call can be found here, as well as an excerpted clip of S&P's global Managing Director of Sovereign Debt Ratings saying that S&P's "upside scenario" is for the Bush tax cuts on the wealthy to expire. That alone, said S&P, would restore the U.S. rating from "outlook negative" to "outlook stable."

BACK TO VICHYDEMS HOME